Lydia E. York Delaware State Auditor

Diamond State Port Corporation Performance Audit

Performance Audit – July 1, 2021 through June 30, 2025

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The State of Delaware Office of Auditor of Accounts (AOA) declared its intention to conduct a performance audit (the “Audit”) on the Diamond State Port Corporation (DSPC) in February 2025. AOA is authorized under 29 Del. C, § 2906(a) to conduct audits of all financial transactions of all state agencies.

The purpose of the Audit was to evaluate the efficiency and effectiveness of DSPC’s operations, provide objective analysis, findings, and conclusions to assist management and those charged with governance and oversight with improving program performance and operations, reducing costs, facilitating decision making by parties responsible for overseeing or initiating corrective action, and contributing to public accountability. This includes but is not limited to assessments of program effectiveness, economy, and efficiency; internal control; compliance; and prospective analyses.

AOA audited DSPC based on events that transpired during the period July 1, 2021, through June 30, 2025.

Key Information and Findings

The Audit consisted of two main objectives:

- Assess the effectiveness of the Port’s performance metrics and financial reporting of current operations in tracking progress toward achieving financial goals as described by the DSPC and its Port Operator.

- Evaluate the accuracy and reliability of the projected economic impact of the Edgemoor container facility improvements at the Port, including job creation, wages, tax benefits, and infrastructure enhancements.

AOA inquired pertinent DSPC board members, contracted vendors, and others, and observed documents to obtain evidence in meeting its objectives. AOA discovered five instances where business processes were lacking proper oversight or utilizing resources that were not expected to be consumed by DSPC.

- Finding 1: DSPC Board of Directors (BOD) held executive meeting sessions that did not meet the requirements for an executive session according to Delaware Code. Additionally, minutes and agendas were not adequately documented and maintained to capture the information being discussed.

- Finding 2: Governance and oversight over the executed Concession Agreement (ECA) with GT USA Wilmington, LLC (GT USA) were not performed in accordance with the requirements of Article 5, Section 5.4, and Article 21, Section 21.3. Similarly, oversight procedures required by Article 5, Section 5.4 of the ECA, as modified by the Second and Third Amendment with Enstructure Wilmington Holdings, LLC (Enstructure), were not carried out.

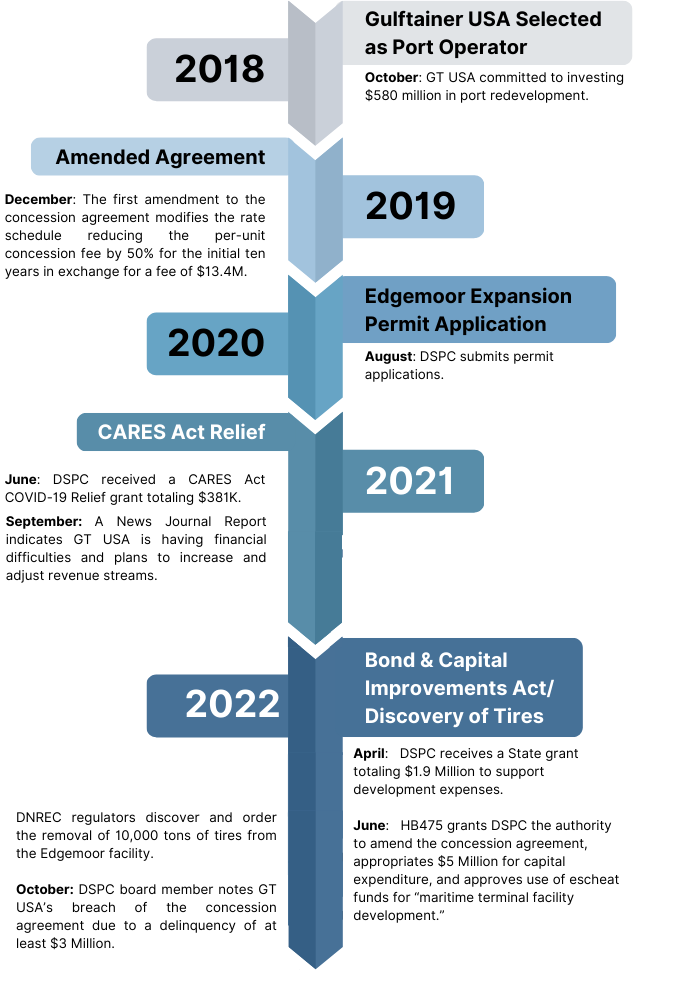

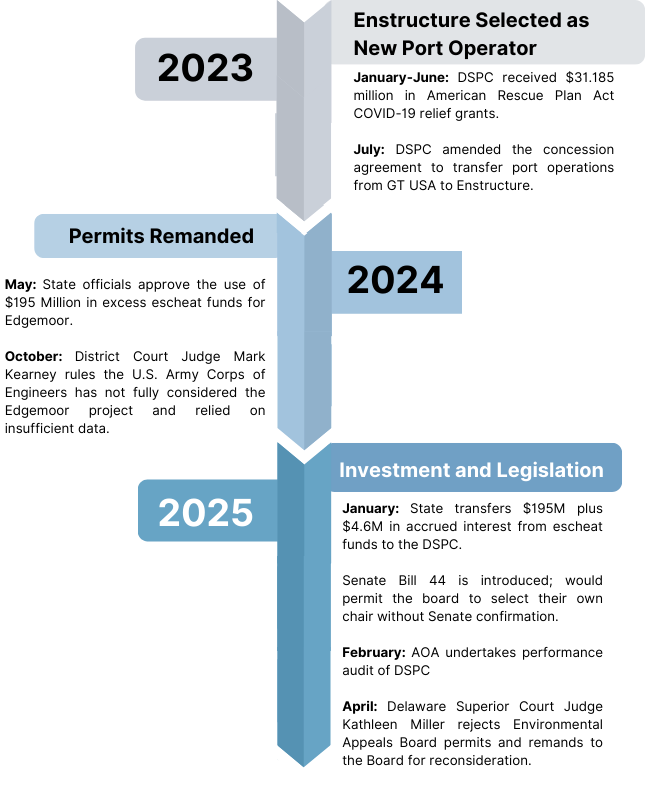

- Finding 3: DSPC was unable to execute the collection of payments, or remedies, in accordance with the ECA with GT USA in a timely manner. The ECA was originally a contract between DSPC (a public sector entity) and GT USA (private sector entity) implemented on September 18, 2018. The agreement allowed GT USA the right to operate and collect revenue for Port operations for a 50-year period. Article 4 Section 4.1 and 4.4 states that GT USA agreed to an initial concession payment of $11,536,000, and a minimum annual concession fee of $3 million. In FY19 DSPC received $3,129,335 upon commencement and received the remaining $8,406,665 in FY20. GT USA had not made minimum annual concession payments and was in payment default in accordance with Article 10 Section 10.1. DSPC entered into Good Faith Negotiations with GT USA in accordance with Article 10 Section 10.8 and passed Resolution 20-03: Authorization of the First Amendment to the Executed Concession Agreement (First Amendment) with GT USA on December 17, 2019, which modified the rate schedule in the ECA.

- Finding 4: The Seabury Report states that the Methodology used in estimates is the Impact Analysis for Planning (IMPLAN) model. In reference to the IMPLAN model the report states “like all input-output models is limited in one critical way, specifically, it is not a dynamic simulation model and therefore is not recommended for rigorous forecasting functions. The main reason for this limitation is that IMPLAN ignores technical change that affects its multipliers.” It also acknowledges “…for long-term investment in infrastructure, researchers will need to make adjustments to the IMPLAN multipliers to account for technological change.” IMPLAN models rely on data sets provided by the BEA. Input-Output analysts must collaborate with Census Bureau data-collection staff to identify changes that affect the industry data. The primary data source for the benchmark Input-Output tables is the Economic Census, which the Census Bureau updates every 5 years, most recently in 2022. DSPC referenced the Seabury Report in its 2024 public releases surrounding the JDA as it relates to job projections, but in the IMPLAN model used in the Seabury Report, the sourced data utilized is prior to the 2022 Economic Census.

- Finding 5: DSPC did not enforce Article 6 Section 6.5 of the ECA for access and inspection. GT USA entered into an agreement with S&A Marketing Company to pay GT USA to facilitate exporting tire remnants/scraps, resulting in tires and tire remnants/scraps being placed at Edgemoor site without securing proper permits and approvals. DSPC passed resolution 23-04 on May 22, 2023, which authorized the DSPC Chair to exercise DSPC’s right under the ECA to take all necessary action to bring the Edgemoor property into compliance, including emergency bid-waiver authority, expending necessary funds, and/or charging GT USA for all costs. An expenditure of $2 million was authorized for the removal of the tires and tire remnants in accordance with the Edgemoor Tires Removal Reimbursement Agreement.