Delaware Agricultural Lands Preservation Foundation FY24

Financial Statement Audit – Fiscal Year Ended June 30, 2024

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The Office of Auditor of Accounts presents a financial statement audit of the governmental activities and major fund of Delaware Agricultural Lands Preservation Foundation (Foundation). This audit was conducted for Fiscal Year ended June 30, 2024. The primary objective of a financial statement audit is to provide reasonable assurance that the financial statements present fairly, in all material respects, the financial position of an entity.

A single audit was also conducted for Fiscal Year ended June 30, 2024. The primary objective of a single audit is to provide assurance that a non-federal entity has adequate internal controls in place and is following program requirements that could have a direct and material effect on the financial statements. All nonfederal entities that expend $750,000 or more in federal funds in their fiscal year are subject to single audit requirements.

AOA completed this engagement under the authority of 29 Del. C., §2906(a) – “The Auditor shall conduct audits of all the financial transactions of all state agencies. To the extent possible, the Auditor shall conduct the audits at least once every 2 years.”

The Agricultural Lands Preservation Act (Act) was enacted on July 8, 1991 to conserve, protect, and encourage the improvement of agricultural lands within Delaware for the production of food and other agricultural products. Preservation of the State’s farmlands and forestlands is considered essential to maintaining agriculture as a viable industry and an important contributor to Delaware’s economy. The Act also provided for the creation of the Agricultural Lands Preservation Foundation. The Foundation has been charged with the authority and responsibility of establishing and administering an extensive statewide program to preserve Delaware’s farmlands and forestlands.

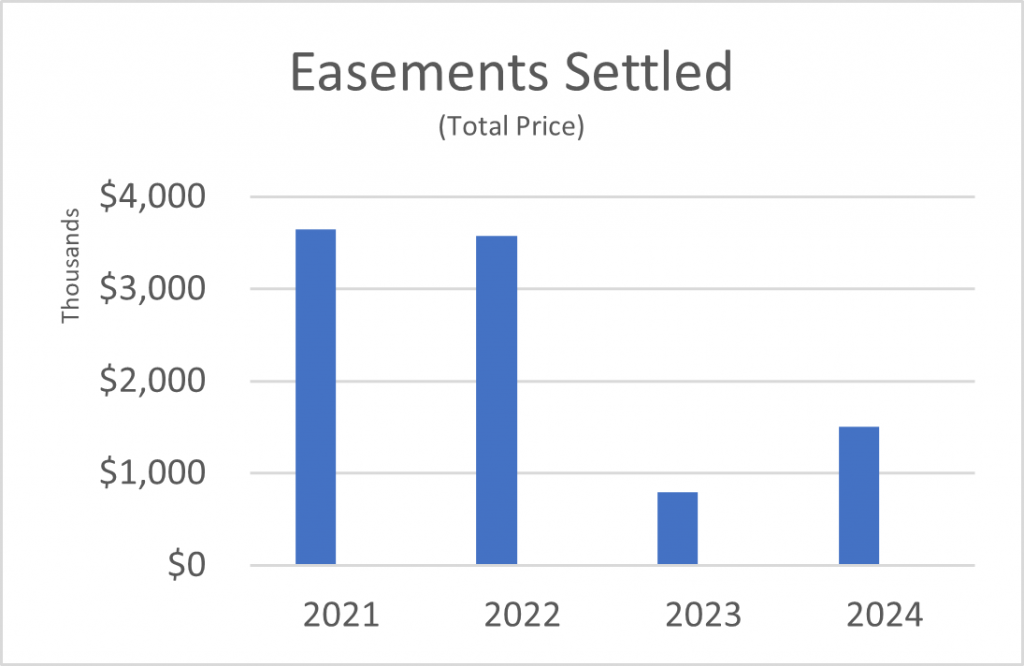

The Foundation preserves land through two major programs. The Aglands Preservation Program and the Young Farmer Loan Program. The Aglands Preservation Program allows landowners to voluntarily preserve their farms through a two-phase process. The first phase, which does not include any payment to the landowner, is known as an Agricultural Preservation District. In phase two, the landowner is paid to sell their farm’s development rights, known as an Agricultural Conservation Easement. The Young Farmer Loan Program offers a 30-year, no interest loan to help young farmers purchase farmland, one of the chief obstacles to starting out in business. The loan is for up to 70 percent of the appraised value of the farm’s development rights, not to exceed $500,000. Farms in the program are placed into a permanent preservation easement.

This engagement, was conducted in accordance with 29 Del. C. §2906.

Key Information and Findings

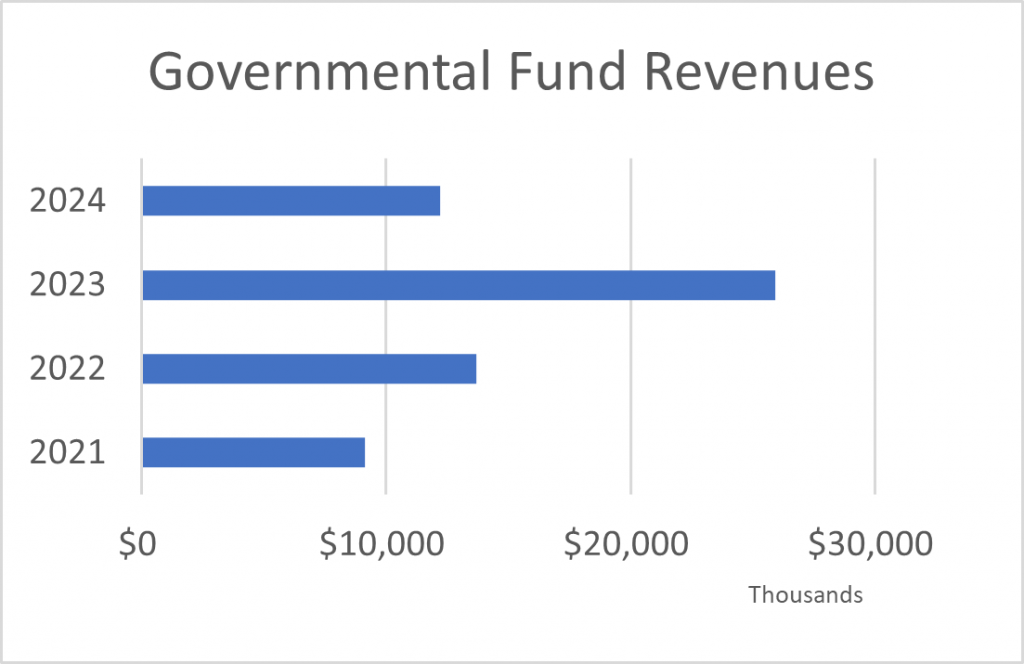

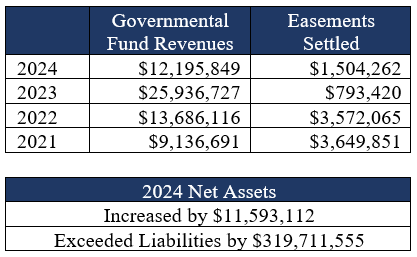

During Fiscal Year Ended June 30, 2024 the Foundation received $10,000,000 in operating grants and contributions from the State of Delaware for use in their programs. Approximately half the amount that was received by the State during Fiscal Year Ended June 30, 2023.

For the Fiscal Year Ended June 30, 2024 total capital assets, net of depreciation, increased by $11,593,112 to $296,682,595 from $285,089,483 through the purchasing of development rights.

The financial statement audit contains an unmodified “clean” opinion. An unmodified opinion expresses that the financial statements present fairly, in all material respects, an entity’s financial position, results of operations and cash flows in conformity with generally accepted accounting principles.

The auditor’s reports over internal control over financial reporting, major programs, and compliance for major programs did not identify any deficiencies in internal control over compliance that is considered to be a material weaknesses.

There were no findings required to be reported under Government Auditing Standards.