Annual Comprehensive Financial Report FY23

Independent Auditor’s Report, Fiscal Year Ended June 30, 2023

Report Summary

Background

The Office of Auditor of Accounts, Delaware Department of Finance, and Division of Accounting present the Annual Comprehensive Financial Report (ACFR), including the Independent Auditor’s Report, for the State of Delaware for the fiscal year ended June 30, 2023.

This ACFR audit was conducted using generally accepted auditing standards (GAAS) in the United States. The internal control report and findings of the ACFR, conducted according to generally accepted government auditing standards (GAGAS), will be presented at a later date.

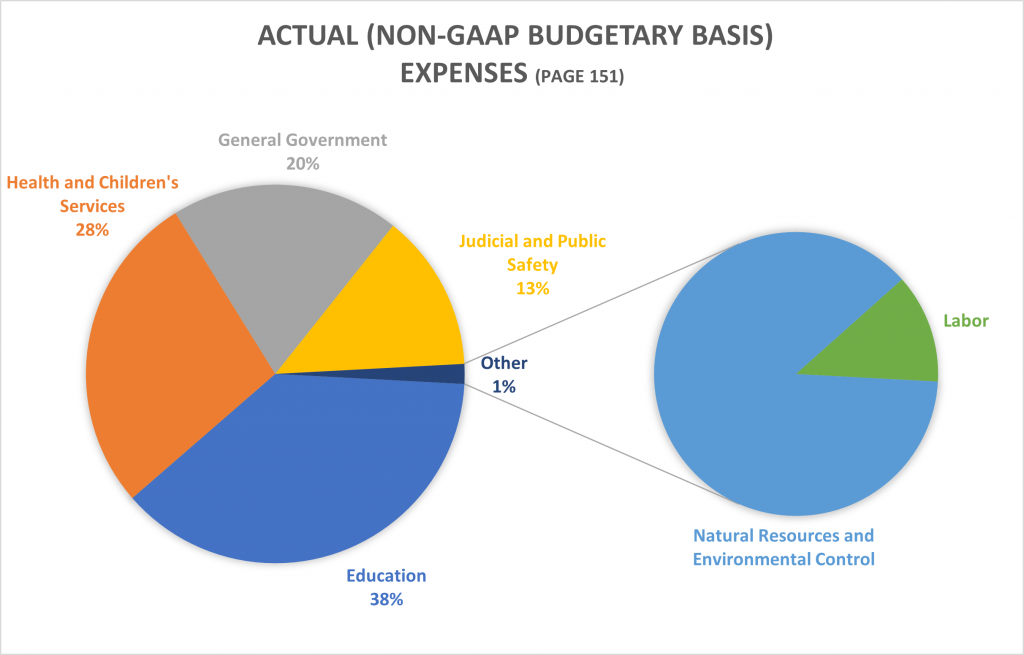

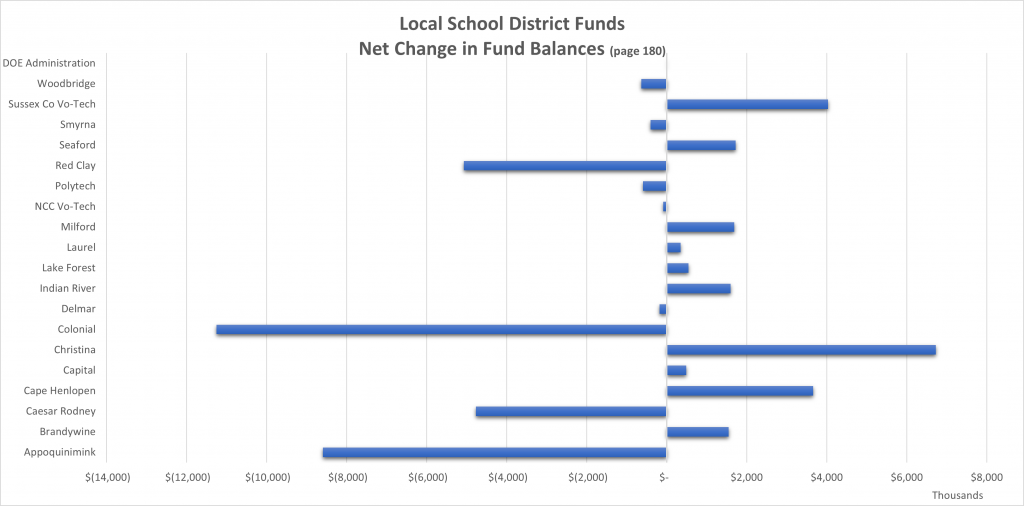

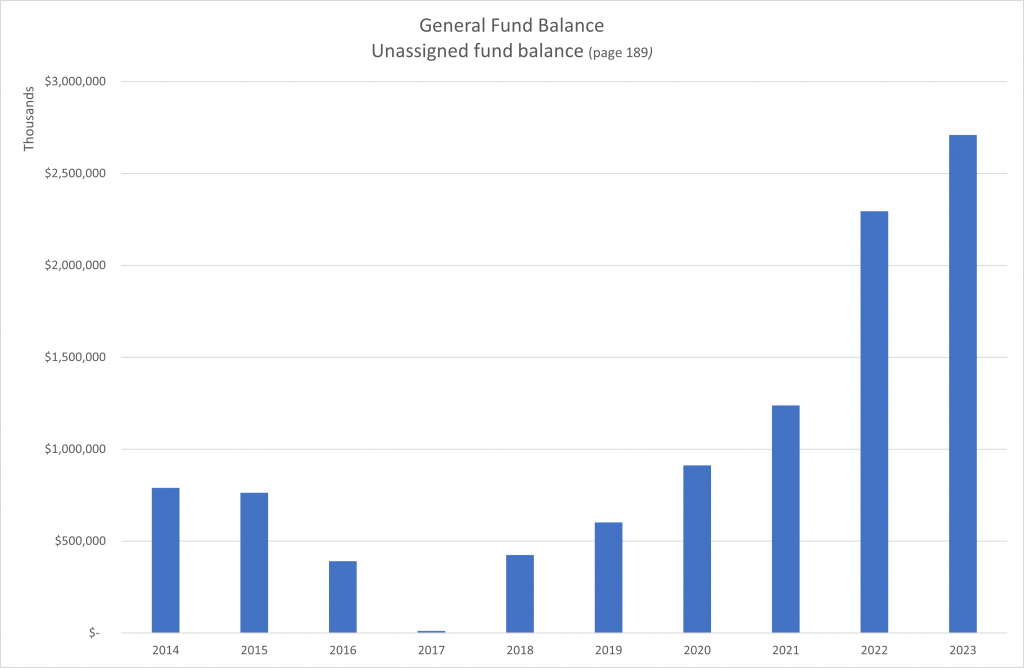

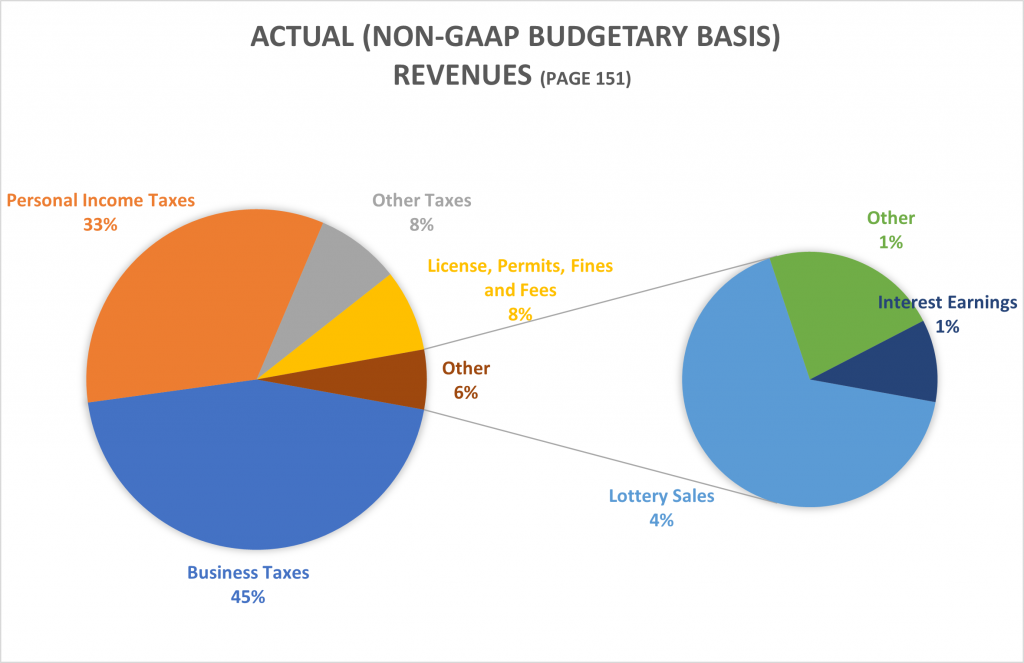

The purpose of the ACFR is to be transparent about the use of taxpayers’ money and to provide an accounting of all state expenditures. The ACFR does this by including dozens of basic and intricate financial reports, along with notes, narratives and supporting data.

The ACFR is an important tool used to analyze the state’s overall financial position for purposes of bond financing and for establishing financial transparency and credibility with its creditors and oversight agencies.

This engagement was performed in accordance with 29 Del. C. § 2906(a).

Key Information and Findings

CliftonLarsonAllen, LLP (CLA) issued its opinions on the State of Delaware Annual Comprehensive Financial Report (ACFR) as of and for the year ended June 30, 2023. CLA included a disclaimer of opinion in its Independent Auditors’ Report on the ACFR and the basis for it:

CLA Basis for Disclaimer of Opinions on Business-type Activities and Unemployment Fund

The State’s Department of Labor was unable to provide sufficient appropriate audit evidence for the balances and financial activity of the account balances of the unemployment fund. The State’s records do not permit us, nor is it practical to extend or apply other auditing procedures, to obtain sufficient appropriate audit evidence to conclude that the account balances and related cash flows in the business-type activities and unemployment fund were free from material misstatement. As a result of these matters we were unable to determine whether further audit adjustments may have been necessary in respect to the unemployment fund account balances, and the elements making up the statement of activities and cash flows.

The State’s ACFR examines all funds, departments, organizations, bureaus, boards, commissions, offices of elected officials and authorities that make up the state’s legal entity. Individually presented component units, which are legally separate entities for which the State is financially accountable, are also included.