Lydia E. York Delaware State Auditor

Town of Ellendale Performance Audit

Calendar Years 2019-2022

Report Summary

Background

The Town Council of Ellendale (the “Town”) engaged the State of Delaware Office of Auditor of Accounts for a performance audit (the “Audit”).

The purpose of our Audit was to evaluate the efficiency and effectiveness of Town operations during calendar years 2019 to 2022. The audit objectives were to assess whether the system of internal controls was adequate and appropriate for the achievement of Town Council objectives regarding compliance, fiscal management, and governance. Audit testing was designed to evaluate key financial processes, internal controls, and compliance with applicable laws, regulations, and the Town charter.

The State Auditor is authorized under 29 Del. C., §2906 to conduct postaudits.

Key Information and Findings

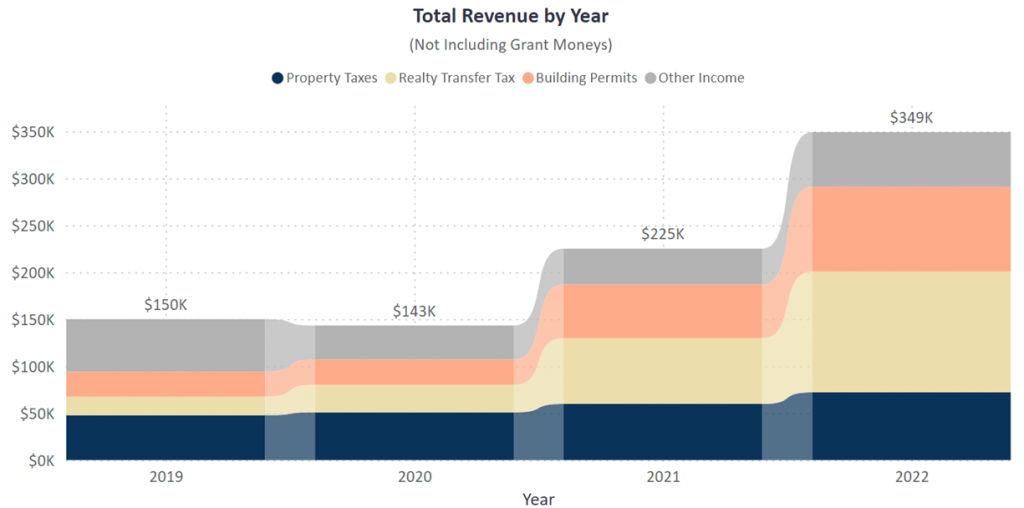

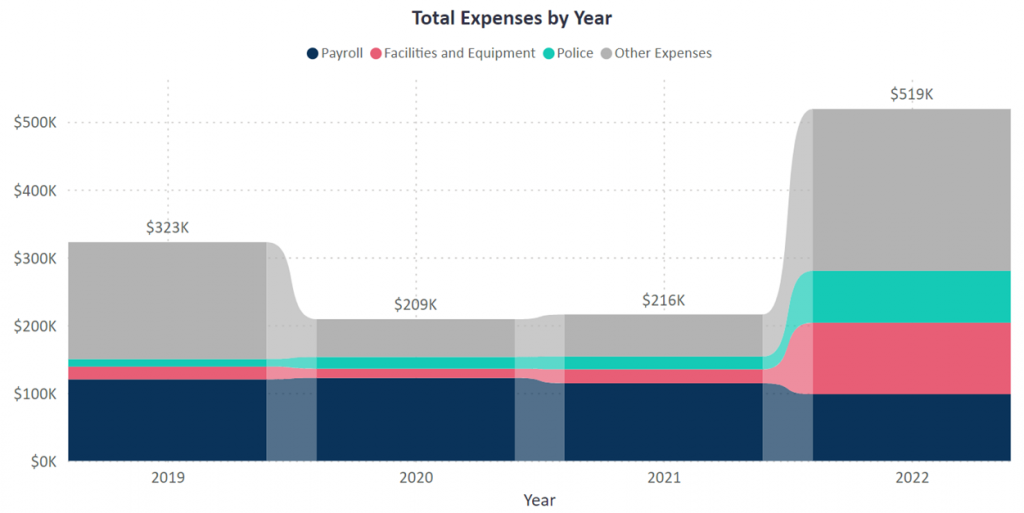

The 2023 Town Council inherited a town with challenges and opportunities. Opportunities for Ellendale stem from its experience in substantial growth from real estate developments. Challenges include establishing the foundation of an internal control framework supported by structured governance with sufficient resources, budget development, and documented policy and procedures. The audit notes concerns surrounding appropriate internal controls to effectively guide, manage, and oversee the Town’s continued development. As the Town grows and expands, there is an anticipated surge in demand for services and a heightened need for accountability. Tackling the challenges faced by the Town will likely enhance public perception, service quality, and overall transparency.

The auditor’s report underscores the need for corrective action in the Town’s operations and internal controls. Auditors found deficiencies in records management, internal control weaknesses, conflicts of interest, and deviations from established governance protocols that have the potential to allow fraudulent activity to go undetected.

The examination of the cash receipts identified missing and unrecorded cash transactions, an indicator of accounting errors or the possible existence of fraudulent activities. The deficiency surrounding cash receipts raises concerns about the accuracy and completeness of financial records, and the failure to document all cash inflows poses risks to financial transparency and the ability to accurately assess the Town’s financial health.

The Audit also identified undocumented expenditures indicating potential issues with the approval and monitoring of disbursements. Expenditures lacking adequate supporting documentation further highlight vulnerabilities in the internal control framework. The Auditor found instances where procurement requirements outlined in the Town charter were not followed, particularly concerning purchases for items exceeding $10,000.

Tax rate changes voted upon at Town council meetings did not result in a required charter update. This oversight resulted in confusion about the tax amounts charged to parcels and may have led to inaccuracies in tax assessments. Audit recalculations found variances in taxes assessed. The discrepancies may have implications for budgeting, financial reporting, and the overall financial health of the municipality. The mismatch of parcel IDs between Town records and county records was identified as a potential contributor to variances in tax assessments.

The Audit found deficiencies in the Town’s records management program. Missing and unfiled documents highlight the need for transparent and efficient processes for managing both physical and electronic records. Incomplete or inaccurate information led to difficulties locating information during the audit.