Lydia E. York Delaware State Auditor

Diamond State Port Corporation FY24

Financial Statement Audit – Fiscal Year Ended June 30, 2024

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The Office of Auditor of Accounts presents a financial statement audit of the Diamond State Port Corporation (DSPC). This audit was conducted for Fiscal Year ended June 30, 2024. The primary objective of a financial statement audit is to provide reasonable assurance that the financial statements present fairly, in all material respects, the financial position of an entity.

The DSPC is a separate entity that is reported as part of the State’s overall financial statements. DSPC serves the State by operating the Port of Wilmington, which is a full-service deep-water port and terminal.

This engagement was conducted in accordance with 29 Del. C. §2906 and 29 Del. C. §8786.

Key Information and Findings

The 2024 financial statements of DSPC reflect the concession agreement as it currently exists between DSPC and Enstructure. The concession agreement has always been accounted for as a leveraged lease in DSPC reports. The 2024 report reflects the Third Amendment to the concession agreement (Third Amendment) that was entered into in July 2023. The amended agreement is for 50 years, a period that began in the fiscal year 2024. In FY2024, Enstructure remitted a $21.5 million contribution per terms of the amended concession agreement.

On November 30, 2001, the Corporation entered into a loan agreement with DelDOT. The Corporation borrowed $27,500,000. The funds were used to repay the balances in full of the original DRBA Note and the Wilmington Trust Company Note, and, at a discount, the City of Wilmington Deferred Payment Note. On February 20, 2024, House Bill 305 passed the Delaware Senate authorizing and directing the Secretary of Transportation “…to cancel any notes and forego all amounts owed under the loan agreement including any outstanding principal and accrued or capitalized interest then payable as of such date of cancellation…” As a result, the Corporation recognized a gain of $16.5 million due to the forgiveness of the loan and interest.

During the first year of the agreement, the Corporation entered into a Reimbursement of Approved Projects Agreement with Enstructure to provide funding for critical deferred maintenance and improvements. The agreement provides $8,800,000 of funding for approved projects that address, equipment and safety issues. As of June 30, 2024, the Corporation accrued a liability of $6,203,387, of which $4,374,702 was for capital improvements and $1,828,685 was for repairs and maintenance, which was recognized. The remaining $2,596,613 of funding for approved projects is expected to be due and payable in FY2025.

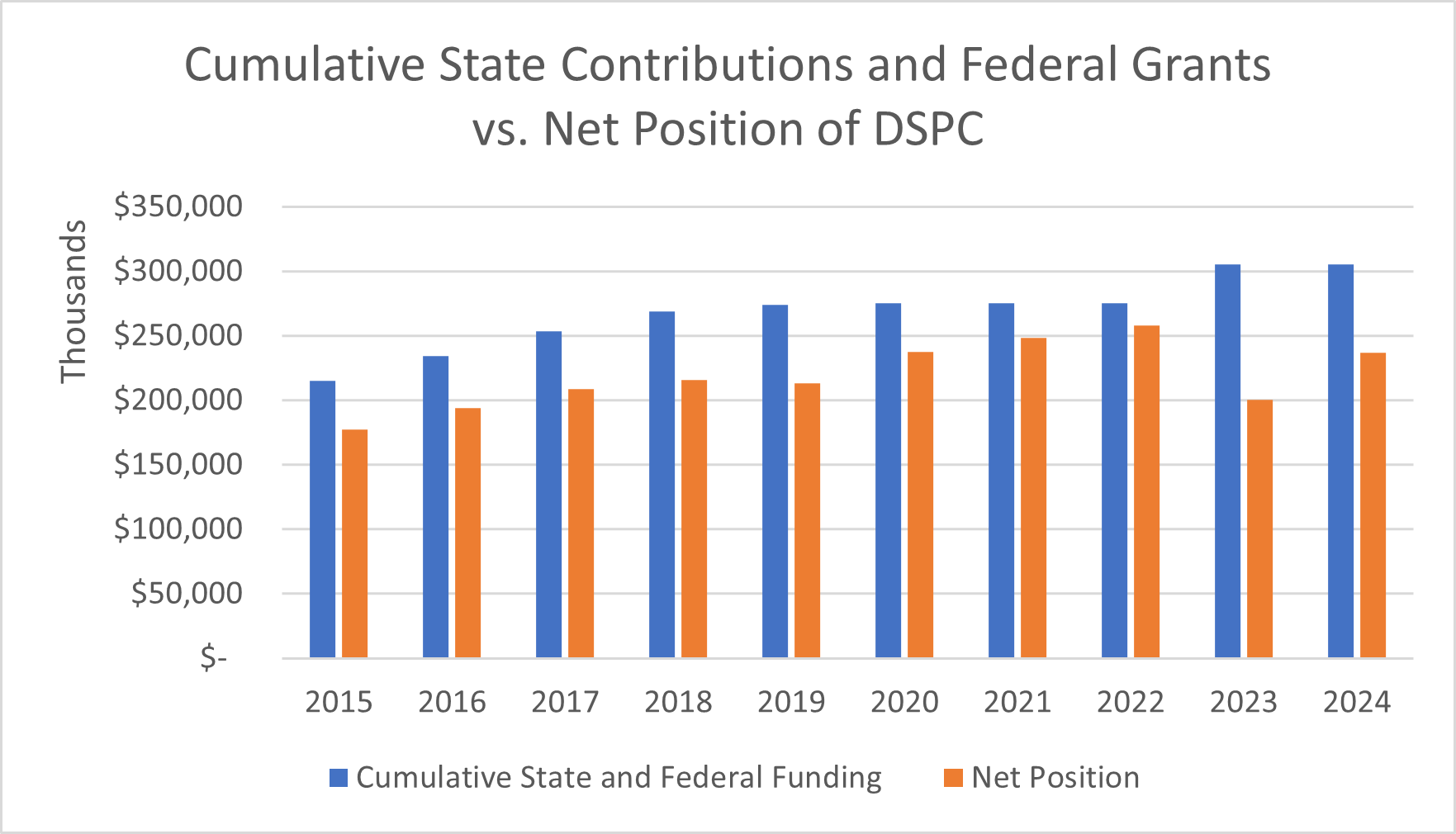

Since its inception in Fiscal Year 1995 through Fiscal Year 2024, the Corporation has received capital contributions from State and Federal grants totaling $305.6 million. The Corporation’s net position (assets + deferred outflows of resources – liabilities – deferred inflows of resources) as of June 30, 2024, was $236.9 million. For the past 10 years, the accumulation of State and Federal Funding exceeded net position of DSPC. In fiscal years 2021 and 2022, DSPC did not receive any contributions from the State. However, in FY 2023, DSPC incurred a loss of $97.3 million from the original concession agreement due to the change in leveraged lease operators from Gulftainer to Enstructure. DSPC received a contribution of $29.9 million from the State to assist in funding the FY2023 loss.

| Since its inception in FY 1995 through FY 2024, DSPC has received $305.6 Million in capital contributions from State and Federal grants . Without State and Federal grants, DSPC would have needed to secure debt financing to operate. |

|---|

The financial statements are reported fairly, in all material respects, regarding 2024 results, however there are two areas that remain of concern with this report:

- Best Practices in Financial Reporting under Government Accounting Standards encourage, but do not require, governmental entities to show comparative financial statements of its operations. Comparative statements allow readers to see the results of operations in a trend-like capacity. DSPC continues to utilize a single year presentation of its financial statements as it navigates the new agreement with Enstructure, which just completed Year 1 of 50 as of June 30, 2024, but DSPC is considered as a leveraged lease operator since October 2018, so comparative presentations could have been produced based on the information that was available.

- Government Accounting Standards require financial statements of a government entity to include a Management Discussion and Analysis (MD&A) section. This section would include the comments of management concerning the results presented from the prior years to the current year. Since a single year presentation was illustrated in the financial statements (per comment 1 of this section), the MD&A highlights DSPC’s most significant financial activities during FY2023 and FY2024. When DSPC illustrates comparative financial statements for future fiscal years, DSPC management should provide comment on the most significant financial activities of the current and prior two fiscal years.