State of Delaware Deferred Compensation Plan

Calendar Year Ended December 31, 2024

January 8, 2026

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The Office of Auditor of Accounts (AOA) performed a financial statement audit of the State of Delaware 457(b) plan for Calendar Year ended December 31, 2024.

This engagement was conducted in accordance with 29 Del. C. § 2722 (e)(7). This section of Delaware Code specifies that “The (Plans Management) Board shall arrange for an annual financial audit of each of the Plans, which shall be provided annually to the General Assembly. The Board shall enter into a memorandum of understanding with the Auditor of Accounts regarding each such audit…”

29 Del. C. § 2906, charges the Auditor of Accounts with the duty of conducting audits of all the financial transactions of all state agencies.

Key Information and Findings

The Plan is a defined contribution plan, under Section 457(b) of the Internal Revenue Code (“IRC”), covering all full-time and part-time employees of the State, including elected or appointed officials who receive compensation wholly or in part directly from the State Treasurer or from the Treasury through an agency within the State that is Wholly or in part supported by the State. The objective of the audit is to provide reasonable assurance that the statements are free from material misstatement and accurately reported.

For the year ended December 31, 2024

The Plan’s investments reported at fair value was $1,016.7 million for 16,509 participants. The average balance per participant was $61,586.

Participant contributions ($49.3 million) and rollovers from other plans ($4.5 million) totaled $53.8 million. The average annual contribution per participant (10,657) was $4,664.

Benefits paid to 2,224 participants were $69.6 million. The average payment to each participant was $31,287.

It is my pleasure to report this audit contains an unmodified opinion. An unmodified opinion is sometimes referred to as a “clean” opinion. It is one in which the auditor expresses an opinion that the financial statements present fairly, in all material respects, an entity’s financial position, results of operations and cash flows in conformity with generally accepted accounting principles.

The results of tests disclosed no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards.

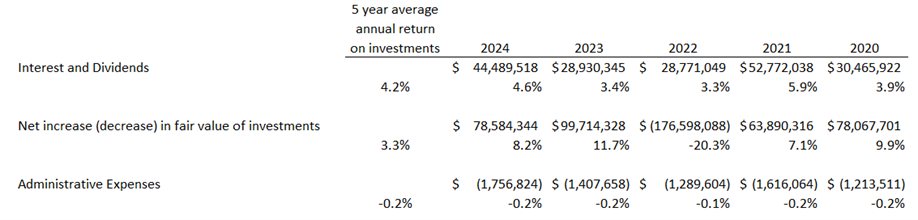

The performance of the Plan’s investments over the past five years (average 7.3%) is shown in the following table: