Town of Smyrna 2022-2023

Performance Audit – Calendar Years 2022 and 2023

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The Town Council (the “Council”) for the Town of Smyrna (the “Town”) engaged the State of Delaware Office of Auditor of Accounts to conduct a performance audit (the “Audit”).

The purpose of our Audit was to evaluate the efficiency and effectiveness of Town operations during calendar years 2022 to 2023. The audit objectives were to assess whether the system of internal controls was adequate and appropriate for the Town and Council to achieve their objectives regarding compliance, oversight, fiscal management, transparency, and governance. Audit testing was designed to evaluate key financial processes, internal controls, and compliance with applicable laws, regulations, and the Town Charter (the “Charter”).

AOA is authorized under 29 Del. C. §2906 to perform this engagement.

Key Information and Findings

The books and records are kept in accordance with generally accepted accounting principles and are reconciled with The Town operates under a Council–Manager form of government. Under this form, the Council is responsible for legislative functions such as establishing policy, passing ordinances, and developing a vision for the Town. The Town Manager oversees each department, manages the Town’s staff, and administers funds.

The Town delivers a comprehensive range of services as required by its Charter and Council-adopted code. These services include public safety (police, fire, and emergency management), infrastructure maintenance (streets and sanitation), community amenities (recreation and public library), urban development (public improvements, planning, and zoning), safety regulations (inspections), utilities (electric power generation and distribution, water supply, and wastewater management), legislative operations, and general administration. The Town has approximately 157 full-time and part-time employees.

During the performance audit, the following areas of concern were noted:

- The Town currently utilizes two distinct computer programs as its main accounting systems for all fiscal activities. The Town is working with a technology company to transition its accounting records from the two systems to a singular software program. The original conversion date was set for September 1, 2022. The Town is currently running both systems in parallel.

- The Town has limited personnel to monitor financial oversight, which hinders the Town from completing its bank reconciliations in a timely manner. There are no clearly defined roles and responsibilities for the development of financial reports to be reviewed by Management or Council with respect to bank reconciliations.

- The Town does not have a formalized written process or procedure that outlines the roles and responsibilities to review, update, track, and approve projects or funding sources for capital projects American Rescue Plan Act (ARPA) funds. The Town was unable to provide documentation related to capital projects including the current status of the project, percentage of funds allocated from a funding source, or the amount of funds utilized and remaining from a funding source.

- The turnover of management and accounting staff has resulted in the lack of continuity in financial oversight practices.

- The Town did not have adequate oversight and monitoring in place to fully adhere to the Town’s procurement policy.

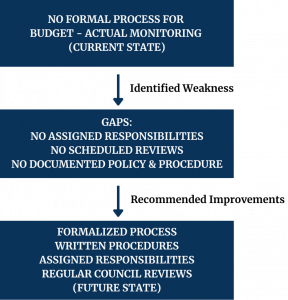

- The Town does not have a formalized process or procedure for management to generate, review, and approve budget to actual comparisons.

- The Town did not have a comprehensive written policy and procedures manual to govern its operations and decision-making processes. There is no clear channel of communications between Council members and Town management.

The auditor’s report underscores the need for corrective action in the Town’s operations and financial governance. Auditors found deficiencies in policy & procedure management and deviations from established governance protocols that increase the risk that misstatement and fraudulent activity could potentially go undetected.

Since the April 2020 census, the Town’s population has grown by 3.4%, leading to several challenges. These include the absence of a structured internal control framework supported by effective governance, adequate staffing, budget planning, and clearly documented policies and procedures. To manage this ongoing growth, the Town should establish robust internal controls that provide guidance, oversight, and governance. As the population continues to expand, the demand for services is expected to rise, along with the need for increased accountability. Proactively addressing these challenges will likely improve public perception, enhance service quality, and promote overall transparency.

TOWN OF SMYRNA ARPA PROGRAM FUND TRACKING

| Subrecipient Name | Town Of Smyrna |

|---|---|

| Grant | ARPA SLFRF |

| ARPA Approved Budget | $10,511,292.82 |

| 2021 Distribution Amount | $3,188,811.46 |

| 2022 Distribution Amount | $3,188,811.47 |

| Total Amount Distributed (2021+2022) | $6,377,622.93 |

| Total ARPA Amount Spent | $5,001,539.03 |

| Total ARPA Amount Remaining | $1,376,083.90 |

| Reporting Period | 01/01/2022 – 12/31/2023 |

Why Internal Controls and Documentation Matter:

The U.S. Treasury and federal regulations require local Governments to implement effective internal controls and maintain detailed documentation to ensure:

- Proper use of federal funds

- Prevention of fraud or misuse

- Readiness for audit or oversight

- Transparency to the public

The Town received $6.38 million in ARPA funds but lacks formal procedures and documentation to track their project use and status.