DE529 Education Savings Plan 2024

Financial Statement Audit – Calendar Year 2024

Sign Up For Our Audit Reports Email Distribution List

Report Summary

Background

The Office of Auditor of Accounts (AOA) performed a financial statement audit of the State of Delaware DE529 Education Savings Plan for Calendar Year ended December 31, 2024.

This engagement was conducted in accordance with 29 Del. C. § 2722 (e)(7). This section of Delaware Code specifies that “The (Plans Management) Board shall arrange for an annual financial audit of each of the Plans, which shall be provided annually to the General Assembly. The Board shall enter into a memorandum of understanding with the Auditor of Accounts regarding each such audit…”

29 Del. C. §2906 charges the Auditor of Accounts with the duty of conducting audits of all the financial transactions of all state agencies.

Key Information and Findings

The Plan was created by the State of Delaware General Assembly under Delaware Title 14, Chapter 34,

pursuant to Internal Revenue Code (IRC) Section 529 to allow residents of Delaware and other states to

make contributions to accounts established for the purpose of meeting qualified education expenses designated beneficiaries of such accounts. Account owners can choose among 36 portfolios, grouped-based on strategies, including aged-based, static, individual fund portfolios, and bank deposit portfolios. The objective of the audit is to provide reasonable assurance that the statements are free from material misstatement and accurately reported.

The DE529 Education Savings Plan includes portfolios that invest in Fidelity actively managed funds (i.e., Fidelity Funds Portfolios), a combination of Fidelity actively managed and Fidelity index funds (i.e., Fidelity Blend Portfolios) and Fidelity Index Portfolios that are invested in Fidelity index funds.

The objectives of the audit are to obtain reasonable assurance about whether the financial statements, as a whole, are free from material misstatements, whether due to fraud or error, and to issue an auditor’s report that includes the auditor’s opinion.

In the auditor’s opinion, the financial statements present fairly, in all material respects, the respective financial position of the 36 investment portfolios as of December 31, 2024, and the respective operations and changes net assets for the year ended are in accordance with accounting principles generally accepted in the United States of America.

This report should be read with the Delaware Qualified Tuition Savings Plan Trust Financial Statement Audit Report Summary for Fiscal Year Ended December 31, 2024.

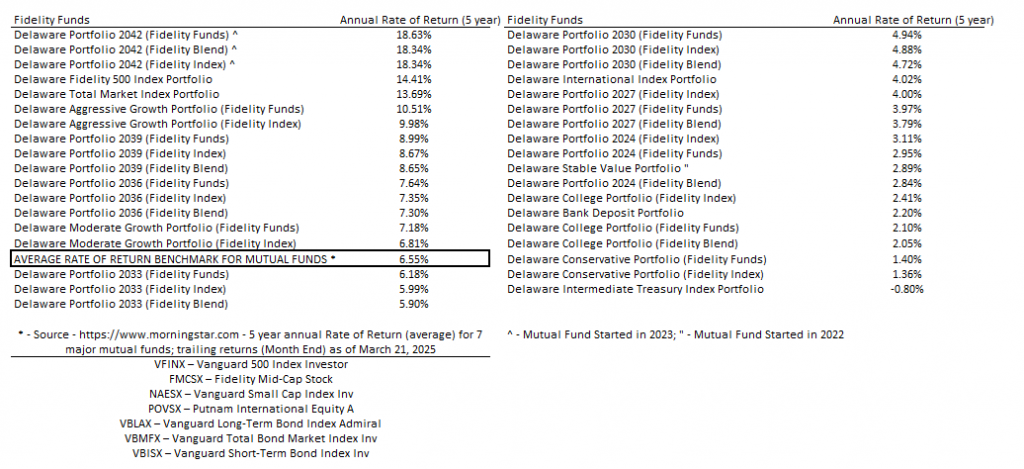

Each individual fund performance over the last 5 years (or shorter duration if Fund started after January 1, 2020) is measured against the above annualized average for the 529 Plan Investments and the benchmark rate of return for all mutual funds in the market: